Optomed Plc Interim report, January – September 2020

Optomed Plc, Stock Exchange Release, 25 November 2020 at 9.00, Helsinki

Optomed Plc: interim report, January – September 2020

July – September 2020

- Revenue decreased by 6.0 percent to EUR 3,338 (3,551) thousand

- EBITDA, gross profit, and gross margin all increased

- Adjusted EBITDA amounted to EUR 229 (-160) thousand corresponding to 6.9 (-4.5) percent of revenue

- The COVID-19 pandemic continued to negatively affect the Devices segment revenue, whereas the Software segment continues its solid performance

- Major Chinese customer continued purchases which drove the revenue growth in China

- The launch of Aurora IQ, the first fully integrated AI camera, is scheduled to begin on 26 November 2020

- US business expansion continues as planned and the first deliveries have been made

- The outlook for 2020 announced on 19 March 2020 remains as is

January – September 2020

- Revenue decreased by 15.8 percent to EUR 8,969 (10,649) thousand

- Adjusted EBITDA amounted to EUR -671 (19) thousand corresponding to -7.5 (0.2) percent of revenue

- The COVID-19 pandemic has negatively affected the Devices segment whereas the Software segment continues its solid performance

Key figures

| EUR, thousand | Q3/2020 | Q3/2019 | Change, % | Q1-Q3/ 2020 |

Q1-Q3/ 2019 |

Change, % | 2019 | ||

| Revenue | 3,338 | 3,551 | -6.0% | 8,969 | 10,649 | -15.8% | 14,977 | ||

| Gross profit * | 2,262 | 2,035 | 11.2% | 6,146 | 7,199 | -14.6% | 9,944 | ||

| Gross margin % * | 67.8% | 57.3% | 68.5% | 67.6% | 66.4% | ||||

| EBITDA | 229 | -546 | 141.9% | -671 | -885 | 24.1% | -335 | ||

| EBITDA margin *, % | 6.9% | -15.4% | -7.5% | -8.3% | -2.2% | ||||

| Adjusted EBITDA * | 229 | -160 | 243.1% | -671 | 19 | -3565.4% | -196 | ||

| Adjusted EBITDA margin *, % | 6.9% | -4.5% | -7.5% | 0.2% | -1.3% | ||||

| Operating result (EBIT) | -278 | -1,109 | 75.0% | -2,312 | -2,563 | 9.8% | -2,596 | ||

| Operating margin (EBIT) *, % | -8.3% | -31.2% | -25.8% | -24.1% | -17.3% | ||||

| Adjusted operating result (EBIT) * | -278 | -723 | 61.6% | -2,312 | -1,659 | -39.4% | -2,457 | ||

| Adjusted operating margin (EBIT margin) *, % | -8.3% | -20.4% | -25.8% | -15.6% | -16.4% | ||||

| Net profit/ loss | -299 | -1,256 | 76.2% | -2,525 | -2,817 | 10.4% | -2,875 | ||

| Earnings per share | -0.02 | -0.14 | 83.7% | -0.19 | -0.32 | 38.8% | -0.32 | ||

| Cash flow from operating activities | -400 | -530 | 24.5% | -3,215 | -1,839 | -74.8% | 161 | ||

| Net Debt | -4,381 | 8,354 | 152.4% | -4,381 | 8,354 | -152.4% | -8,940 | ||

| Net debt/ Adjusted EBITDA (LTM) | 5.0 | 8.5 | 5.0 | 8.5 | 45.6 | ||||

| Equity ratio * | 66.5% | 28.0% | 66.5% | 28.0% | 57.2% | ||||

| R&D expenses personnel | 248 | 342 | -27.3% | 1,011 | 1,096 | -7.8% | 1,540 | ||

| R&D expenses other costs | 31 | 79 | -61.0% | 152 | 168 | -9.8% | 234 | ||

| Total R&D expenses | 279 | 421 | -33.6% | 1,163 | 1,265 | -8.1% | 1,774 | ||

| *) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations. | |||||||||

CEO comments

The negative impact of the COVID-19 pandemic on the fundus camera market, the related software market and hence to Optomed’s business continued during the third quarter. The demand for fundus cameras and artificial intelligence solutions showed signs of recovery in several countries, but this was not yet fully reflected in revenue growth. Deliveries and deployment of new devices and solutions remained challenging as hospitals and clinics limited vendors ’access to their facilities. Our Software segment continued its solid performance driven by stable recurring revenue streams from existing customers and maintained good profitability.

Despite the new wave of the pandemic and its impact on healthcare units’ operations, the demand for our fundus cameras began to recover during the third quarter in China as well as in some European countries. This was reflected as revenue growth in our Devices segment compared to the very challenging second quarter. We expect the global market to continue this favorable development, despite the COVID-19 related restrictions will continue in hospitals and clinics at least throughout the acceleration phase of the pandemic, affecting our short-term revenue growth negatively.

Sales growth in China was driven by the general recovery of the market and especially due to our Chinese key customer’s device purchases. Handheld camera sales in China are expected to remain strong throughout the rest of the year. A similar recovery in demand was also seen in parts of Europe and Russia. In contrast, the markets in the Americas, Asia and the Middle East are still suffering significantly from the slowdown caused by the pandemic. The company’s global OEM customers continued to reduce their inventories and did not order significant quantities of new products from Optomed during the quarter.

Despite the pandemic, our market expansion to the USA is progressing well. During the quarter we signed strategic cooperation agreements with various clinical and commercial partners, started new pilot projects and made the first camera deliveries to major reference customers. In addition, the pilot phase of a clinical trial aiming for an FDA approval for the combined product consisting of Optomed Aurora and AEYE Health’s diabetic retinopathy AI algorithm. The introduction of AI in eye disease screening is currently making significant progress, especially in the United States, where a new reimbursement code for autonomous AI for diabetic retinopathy screening has been opened and will be in use starting 2021. Optomed’s goal is to continue to be among the leading companies in commercializing AI solutions. Additionally, Optomed has signed a distribution agreement with Eyenuk Inc, a global AI medical technology company. The agreement enables Eyenuk to sell Optomed’s handheld fundus cameras in the Americas.

The development of our new products is proceeding as planned. After the review period, we received a medical devices regulatory approval in the People’s Republic of China for Optomed’s latest generation handheld camera, Optomed Aurora. This allows Optomed to start commercial operations of the Aurora camera in China. The commercial launch of Aurora IQ, our AI-integrated handheld fundus camera will begin with a global launch event on 26th November 2020. We expect these significant product launches to favorably support the sales development of our cameras starting next year. We also expect the Aurora IQ to significantly accelerate the growth in the number of users of our AI services. Although the pandemic will largely determine the near-term outlook for the Devices segment, the product launches described above, combined with various solution sales opportunities and the opening of potential new customer segments and geographies, will create a solid base for the company’s revenue to return to growth in 2021. Optomed’s strong financial position enables the company to be ready to respond to the recovery in demand and opportunities in the market.

CEO,

Seppo Kopsala

Outlook 2020 (Unchanged)

We continue to progress our expansion towards the US market and grow our international distributor network. Additionally, we are currently investing in the development of our first fully integrated AI camera with expected commercial launch during 2020.

Optomed expects its revenue to decline during 2020.

The COVID-19 pandemic has a negative effect on Optomed’s growth and business in 2020.

Telephone conference

A telephone conference for analysts, investors and media will be arranged on 25 November 2020 at 11.00 EET. The event will be held in English. The presentation material will be available at www.optomed.com/investors 10.00 EET at the latest.

The participants are requested to register for the call in advance by email to sakari.knuutti@optomed.com.

Please see the call-in numbers below:

FI +358 9 856 26300

SE +46 8 505 218 52

UK +44 20 3321 5273

US +1 646 838 1719

FR +33 1 70 99 53 92

The conference id is 346 945 274#.

Please note that by dialing into the conference call, the participant agrees that personal information such as name and company name will be collected.

Group performance

July – September 2020

In July-September 2020, Group revenue decreased by 6.0 percent to EUR 3,338 (3,551) thousand. The Software segment’s solid performance continued, and its revenue increased by 6.7 percent. Postponed diabetic retinopathy screenings and other diagnostic examinations have also slowly started to recover during the review period. The Devices segment was still affected by the pandemic, but the market showed signs of recovery. Devices segment’s revenue decreased by 17.5 percent. This is a clear improvement over the second quarter and an indication of market recovery towards the end of the quarter. The Group gross margin increased to 67.8 from 57.3 percent last year. The company recorded governmental grants of EUR 29 (-235) thousand during July-September. The grant received during the comparative period 2019 includes a negative project adjustment of EUR 317 related to an EU financed development project. The July-September Group gross margin excluding grants was 66.9 percent in 2020 and 63.9 percent in 2019. The increase is due to Software segment’s increased share of total revenue.

In July-September 2020, Group EBITDA amounted to EUR 229 (-546) thousand and adjusted EBITDA totaled EUR 229 (-160) thousand. The July-September 2019 was affected by EUR 386 thousand of IPO expenses classified as items affecting comparability. The main reasons for the positive adjusted EBITDA variance versus 2019 were higher gross margin and lower operating expenses as a result of the company’s swift response to the pandemic and the related cost reduction actions. The company has since April cut travelling, postponed external events and commenced part time temporary layoffs. The layoffs were still in effect during the quarter. EBIT was EUR -278 (-1,109) thousand and adjusted EBIT was EUR -278 (-723) thousand.

In July-September 2020, net financial items amounted to EUR -41 (-142) thousand and consisted mainly of interest payments to financial institutions and the translation effect of Chinese RMB to EUR. Third quarter of 2020 was also affected by an increase in investments in low risk money market funds.

January – September 2020

In in July-September 2020, Group revenue decreased by 15.8 percent to EUR 8,969 (10,649) thousand. The Software segment performed well considering the ongoing COVID-19 situation, and its revenue growth was 2.1 percent driven by stable recurring business from the existing customers. The Devices segment’s revenue decreased by 34.8 percent. The decrease was a result of the COVID-19 pandemic which halted personal sales work to clinics and hospitals, and deliveries to our OEM customers have been postponed as they have reacted to this unusual market situation by reducing their own inventories. The gross margin increased to 68.5 percent from 67.6 percent of the comparison period. The company received governmental grants of EUR 117 (242) thousand in the first nine month of 2020 and 2019, which increased the gross margin of both periods. The grant for the comparison period 2019 included a negative adjustment of EUR 317 thousand for an EU-funded RD project. The January-September gross margin excluding grants was 67.2 percent in 2020 and 65.3 percent in 2019.

In January-September 2020 EBITDA amounted to EUR -671 (-885) thousand and adjusted EBITDA totaled EUR -671 (19) thousand. January-September 2019 was affected by EUR 904 thousand of IPO expenses classified as items affecting comparability. The main reasons for the adjusted EBITDA variance versus 2019 were lower revenue and gross profit which were partly compensated by lower operating expenses due to the layoffs, lower level of corporate travelling, as well as external events that had been cancelled or postponed due to the COVID-19 situation. EBIT was EUR -2,312 (-2,563) thousand and adjusted EBIT was EUR -2,312 (-1,659) thousand.

Net financial items amounted to EUR -272 (-289) thousand in January-September 2020 and consisted mainly of interest payments to financial institutions and the translation effect of Chinese RMB to EUR.

Cash flow and financial position

In January-September 2020, the cash flow from operating activities amounted to EUR -400 (-530) thousand. Net cash used in investing activities was EUR -398 (-314) thousand and relates mainly to capitalized development expenses. Net cash from financing activities amounted to EUR -82 (43).

Consolidated cash and cash equivalents at the end of the period amounted to EUR 10,899 (1,721) thousand. Interest-bearing net debt totaled EUR -4,381 (8,354) thousand at the end of the period.

Net working capital was EUR 3,862 (2,654) thousand at the end of the period.

Devices segment

Optomed has two synergistic business segments: Devices and Software.

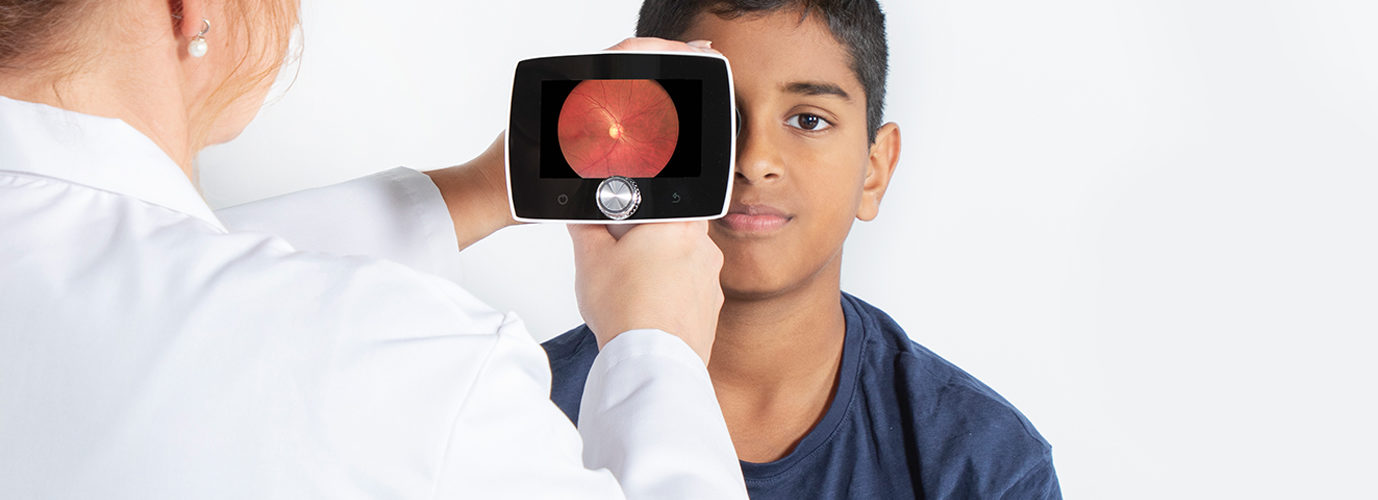

The Devices segment develops, commercializes and manufactures easy-to-use, and affordable handheld fundus cameras, that are suitable for any clinic for screening of various eye diseases, such as diabetic retinopathy, glaucoma and AMD (Age Related Macular Degeneration).

| EUR, thousand | Q3/2020 | Q3/2019 | Change, % | Q1-Q3/2020 | Q1-Q3/2019 | Change, % | 2019 |

| Revenue | 1,537 | 1,863 | -17.5 % | 3,359 | 5,152 | -34.8 % | 7,309 |

| Gross profit * | 933 | 768 | 21.4 % | 1,872 | 3,087 | -39.4 % | 4,200 |

| Gross margin, % * | 60.7 % | 41.2 % | 55.7 % | 59.9 % | 57.5% | ||

| EBITDA | 290 | -155 | -287.7 % | -251 | -240 | -4.8 % | -408 |

| EBITDA margin, % * | 18.9 % | -8.3 % | -7.5 % | -4.7 % | -5.6% | ||

| Operating result (EBIT) | -62 | -562 | 89,0 % | -1,437 | -1,373 | -4.6 % | -1,913 |

| Operating margin (EBIT), % * | -4.0 % | -30.2 % | -42.8 % | -26.7 % | -26.2% |

*) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations.

July- September 2020

In July-September 2020, the Devices segment revenue decreased by 17.5 percent. The decrease was, as in the second quarter, caused by the pandemic affecting personal sales work to hospitals and clinics. Deliveries to OEM customers were postponed as they have reacted to the unusual market situation by reducing their own inventories. Signs of recovery were seen in certain markets such as China and later in the European countries. The revenue grew in China driven by the major Chinese customer returning to normal order levels.

In July-September 2020, the gross margin increased to 60.7 percent from 41.2 percent in the previous year. The company received governmental grants of EUR 29 (-235) thousand in the third quarter of 2020. The grant in 2019 included a negative project adjustment of EUR 317 related to an EU financed development project. The gross margin excluding grants was 58.8 percent in 2020 and 53.8 percent in 2019. The remaining variance was due to decreased OEM sales and increased sales of the Aurora camera.

In July-September 2020, EBITDA was EUR 290 (-155) thousand or 18.9 (-8.3) percent of revenue. The key driver for the increase in EBITDA was the improved gross margin and lower operating expenses related to lower employee related expenses due to layoffs and COVID-19 outbreak affecting corporate traveling and external events.

January- September 2020

In January-September 2020, the Devices segment revenue decreased by 34.8 percent caused by the COVID-19 pandemic.

In January-September 2020, the gross margin decreased to 55.7 percent from 59.9 percent in the previous year. The company received governmental grants of EUR 101 (175) thousand in 2020. The gross margin excluding grants was 52.7 percent in 2020 and 56.5 percent in 2019.

In January-September 2020, EBITDA was EUR -251 (-240) thousand or -7.5 (-4.7) percent of revenue. In spite the revenue decreased by 34.8 percent, the EBITDA was roughly on the same level due to the cost saving measures started in response to the pandemic.

Software segment

Optomed has two synergistic business segments: Devices and Software.

The Software segment develops and commercializes screening software for diabetic retinopathy and cancer screening for healthcare organizations. The segment also distributes off-the-shelf products from selected partners to supplement its own solutions and expertise and provides software consultation to support the Devices segment screening solution projects.

| EUR, thousand | Q3/2020 | Q3/2019 | Change,% | Q1-Q3/ 2020 |

Q1-Q3/ 2019 |

Change,% | 2019 |

| Revenue | 1,802 | 1,688 | 6.7 % | 5,610 | 5,497 | 2.1 % | 7,668 |

| Gross profit * | 1,330 | 1,267 | 5.0 % | 4,274 | 4,112 | 3.9 % | 5,744 |

| Gross margin, % * | 73.8 % | 75.0 % | 76.2 % | 74.8 % | 74.9% | ||

| EBITDA | 444 | 426 | 4.2 % | 1,291 | 1,190 | 8.4 % | 1,667 |

| EBITDA margin, % * | 24.6 % | 25.2 % | 23.0 % | 21.7 % | 21.7% | ||

| Operating result (EBIT) | 289 | 271 | 6.9 % | 836 | 646 | 29.4 % | 909 |

| Operating margin (EBIT), % * | 16.1 % | 16.0 % | 14.9 % | 11.7 % | 11.9 % |

*) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations.

July – September 2020

In July-September 2020, the Software segment had another successful quarter and the revenue increased by 6.7 percent and was EUR 1,802 (1,688). The performance was driven by the stable recurring business with the current customer base that was not affected by the pandemic. Previously postponed diabetic retinopathy screenings and various other diagnostic examinations were slowly recovering towards the end of the quarter.

In July-September 2020 the gross margin was 73,8 percent (75,0). EBITDA stood at EUR 444 (426) thousand or 24.6 (25.2) percent of revenue, respectively. The travel restriction due to the pandemic have slowed down the global screening solution sales.

January – September 2020

In January-September 2020, the Software segment revenue increased by 2.1 percent and was EUR 5,610 (5,497) thousand. The gross margin included governmental grants of EUR 16 thousand in 2020 compared to EUR 67 thousand in 2019. EBITDA was EUR 1,291 (1,190) thousand or 23.0 (21.7) percent of revenue.

Group-wide expenses

Group-wide expenses relate to functions supporting the entire group such as treasury, group accounting, legal, HR, IT and public listing expenses.

July – September 2020

In July-September 2020, group-wide operating expenses amounted to EUR 505 (817). The third quarter of 2019 includes IPO expenses of EUR 386 thousand. The increase in review period excluding the IPO expenses was EUR 74 thousand and is related to the transfer of management function and marketing from segments to group-wide expenses.

January – September 2020

In January-September 2020, group-wide operating expenses amounted to EUR 1,711 (1,827). The first nine months period of 2019 includes IPO expenses of EUR 904 thousand. The increase is related to the strengthened management functions and transfer of marketing from Devices segment to group-wide expenses.

Personnel

Number of personnel at the end of the reporting period.

| 9/2020 | 9/2019 | 12/2019 | |

| Devices | 54 | 56 | 54 |

| Software | 38 | 36 | 40 |

| Group common | 17 | 13 | 14 |

| Total | 109 | 105 | 108 |

Corporate Governance

Optomed complies with Finnish laws and regulations, Optomed’s Articles of Association, the rules of Nasdaq Helsinki and the Finnish Corporate Governance Code 2020 issued by the Securities Market Association of Finland. The code is publicly available at http://cgfinland.fi/en/. Optomed’s corporate governance statement 2019 is available on the company website www.optomed.com/investors/.

Annual General Meeting

The Annual General Meeting held on 11 June 2020 approved the financial statements, adopted the Remuneration Policy for governing bodies and discharged the responsible parties from liability for the financial period ended 31 December 2019.

The Annual General Meeting resolved in accordance with the proposal of the Board of Directors that no dividend will be paid for the year 2019.

The number of members of the Board of Directors was confirmed as five:

- Seppo Mäkinen, Petri Salonen, Reijo Tauriainen and Jun Wu were re-elected as members of the Board

- Anna Tenstam was elected as a new member of the Board

The Annual General Meeting confirmed the annual Board remuneration as follows:

- Chairman of the Board EUR 36,000

- Members of the Board EUR 18,000

In addition, a meeting fee in the amount of EUR 500 is paid to the Chairman of the Audit Committee for each Audit Committee meeting. 40 percent of the Board remuneration is paid in Optomed shares and 60 percent in cash. The remuneration was paid in August, after Optomed’s H1 report was announced.

The Annual General Meeting decided that KPMG Oy Ab, authorized public accountants is elected as the Company’s auditor. KPMG Oy Ab has informed the Company that Authorized Public Accountant Tapio Raappana would continue as the auditor with principal responsibility. Auditor’s remuneration will be paid in accordance with an invoice approved by the Company.

The General Meeting approved the authorization for the Board of Directors to accept as pledge and repurchase of Optomed’s own shares. Altogether no more than 1,400,314 shares may be repurchased or accepted as pledge. The authorization will be valid until the earlier of the end of the next Annual General Meeting or 18 months from the resolution of the Annual General Meeting.

The General Meeting authorized the Board of Directors to decide on the issuance of shares as well as the issuance of options and other special rights entitling to shares referred to in chapter 10 section 1 of the Finnish Companies Act. The number of shares to be issued based on this authorization may not exceed 1,400,314. The Board of Directors is authorized to resolve on all terms and conditions of the issuance of shares and special rights entitling to shares, including the right to derogate from the pre-emptive right of the shareholders. The authorization will be valid until the earlier of the end of the next Annual General Meeting or 18 months from the resolution of the Annual General Meeting.

At its meeting held after the Annual General Meeting, the Board of Directors elected from among its members Petri Salonen as its Chairman. The committee members were elected as follows:

Audit Committee:

Reijo Tauriainen (chairman)

Seppo Mäkinen

Anna Tenstam

Remuneration Committee:

Seppo Mäkinen (chairman)

Reijo Tauriainen

Anna Tenstam

Shares and shareholders

The company has one share series with all shares having the same rights. At the end of the review period Optomed Plc’s share capital consisted of 14,003,144 shares and the company held 775,878 shares in the treasury which corresponds approximately 5.5 percent of the total amount of the shares and votes. Additional information with respect to the shares, shareholding and trading can be found on the company’s website www.optomed.com/investors/.

Risks and uncertainties

The key risks and uncertainties are described in the company’s annual report 2019 which was published on 20 March 2020. The complete report is available at https://www.optomed.com/investors/. In this financial report, the company describes only the changes to the complete risks and uncertainties described in the annual report.

The COVID-19 coronavirus risk as disclosed in the H1-2020 report has been updated as follows:

COVID-19 coronavirus

The COVID-19 outbreak has turned into a pandemic the length and prolonged effect of which are uncertain.

The company’s software segment continues to be largely unaffected due to recurring nature of the business and long-term customer agreements, however, the Devices segment sales have been negatively affected by the pandemic. The medical sector as a whole is concentrated on addressing the immediate pandemic and other supplier meetings and purchases are postponed. This has an effect on the company’s ability to sell its devices and increase its customer base especially because face-to-face meetings are market standard for fundus camera sales.

Currently, it seems like the PRC and the APAC have recovered from the pandemic and demand is picking up again in these regions. However, Europe and the US have been hit by a new wave of infections which may have a negative effect on both the European sales and the US operations that are in the ramp-up phase. Further, Optomed recognizes the risk of a prolonged pandemic which may cause additional restrictions and other negative effects globally and especially also in the currently mostly unaffected regions such as the PRC and the APAC. The company has taken precautions to protect its currently strong cash position.

Other events

On 18 September 2020, Optomed announced that Optomed and AEYE Health agreed to enter into clinical and commercial collaboration to introduce an AI fundus camera Aurora AEYE. The collaboration includes a clinical trial with the aim to receive U.S. Food and Drug Administration (FDA) approval for autonomous AI for retinal screening.

On 11 September 2020, Optomed announced the composition of the shareholders Nomination Board. The shareholders represented in the shareholders’ Nomination Board are Cenova Capital’s controlled entities (Alnair Investments, Cenova China Healthcare Fund IV and Shanghai Cenova Innovation Venture Fund (Limited Partnership)), Robert Bosch Venture Capital GmbH and Aura Capital Oy. These shareholders have appointed the following persons to the Nomination Board:

- Hai Wu, Cenova Capital

- Ingo Ramesohl, Robert Bosch Venture Capital GmbH

- Jarmo Malin, Aura Capital Oy

The Nomination Board is to prepare proposals on the composition and members of the Board of Directors and their remuneration for the next Annual General Meeting and it will submit its proposal to the Board of Directors 31 January 2021 at the latest.

Events after the review period

On 13 November 2020, Optomed announced that it has received a medical devices regulatory approval in the People’s Republic of China for Optomed’s latest generation handheld camera, Optomed Aurora. The Chinese Food and Drug Administration (CFDA) approval allows Optomed to start commercial operations of Optomed Aurora in the People’s Republic of China. Prior to this approval, Optomed has only been able to sell its previous generation camera, Smartscope Pro, in China.

Audit review

This financial report has not been audited by the company’s auditors.

For more information, contact

Lars Lindqvist, CFO

Tel: +46 702 59 57 89

E-mail: lars.lindqvist@optomed.com

Seppo Kopsala, CEO

Tel.: +358 40 555 1050

E-mail: seppo.kopsala@optomed.com

About Optomed

Optomed is a Finnish medical technology company and one of the leading providers of handheld fundus cameras. Optomed combines handheld fundus cameras with software and artificial intelligence with the aim to transform the diagnostic process of blinding eye-diseases such as rapidly increasing diabetic retinopathy. In its business Optomed focuses on eye-screening devices and software solutions related R&D in Finland and sales through different channels in over 60 countries. The company has an extensive portfolio of 55 international patents protecting the technology. In 2019, Optomed’s revenue reached EUR 15 million and the company employed 108 professionals.

Alternative Performance Measures

Optomed uses certain alternative performance measures (APMs) with the purpose to provide a better understanding of how the business develops. These APMs, as defined, cannot be fully compared with other companies’ APMs.

| Alternative Performance Measures | Definition | |

| Gross profit | Revenue + Other operating income – Materials and services expenses | |

| Gross margin, % | Gross profit / Revenue | |

| EBITDA | Operating result before depreciation, amortisation and impairment losses | |

| EBITDA margin, % | EBITDA / Revenue | |

| Operating result | Profit/loss after depreciation, amortisation and impairment losses | |

| Operating margin, % | Operating result / Revenue | |

| Adjusted operating result | Operating result excluding items affecting comparability | |

| Adjusted operating margin, % | Adjusted operating result / Revenue | |

| Adjusted EBITDA | EBITDA excluding items affecting comparability | |

| Adjusted EBITDA margin % | Adjusted EBITDA / Revenue | |

| Items affecting comparability | Material items outside ordinary course of business including restructuring costs, net gains or losses from sale of business operations or other non-current assets, strategic development projects, external advisory costs related to capital reorganisation, impairment charges on non-current assets incurred in connection with restructurings, compensation for damages and transaction costs related to business acquisitions. | |

| Net Debt | Interest-bearing liabilities (borrowings from financial institutions, government loans and subordinated loans) – cash and cash equivalents (excl. lease liabilities according to IFRS 16) | |

| Net Debt / Adjusted EBITDA (LTM), times | Net Debt / Adjusted EBITDA (for the last twelve months, LTM) | |

| Earnings per share | Net result / Number of outstanding shares (reflecting changes in the number of shares following the resolution of the EGM to split the shares of the company with a ratio of 1:20) | |

| Equity ratio, % | Total equity / Total assets | |

| R&D expenses | Employee benefit expenses for R&D personnel and other operational expenses related to R&D activities | |

| Organic growth, % | Organic growth refers to revenue growth excluding (i) growth attributable to acquisitions and divestments; and (ii) growth attributable to fluctuations in exchange rates. The various components in organic growth are calculated as follows:

Acquisitions and divestments: Show how acquisitions and divestments completed during the relevant period have affected the reported revenues. To estimate the impact of acquisitions on reported revenue, the revenue from the contributions of the acquired units for the current period is subtracted from the total revenue for the same period. To estimate the impact of divestments on reported revenue, the revenue from the contributions from the divested units for the current period is subtracted from the total revenue from the previous respective comparison period.

Currency fluctuations: Shows how the reported revenue has been affected by the translation of revenue generated in other currencies than the euro (which is the Group’s accounting currency) when there are exchange rate differences between the current period and the corresponding comparative period. Income in currencies other than euro for the comparative period is recalculated using the applicable exchange rate for the current period to eliminate the effects of exchange rate fluctuations for the relevant period.

|

|

Reconciliation of Alternative Performance Measures

| In thousands of euro | Q3/2020 | Q3/2019 | Q1-Q3/2020 | Q1-Q3/2019 | 2019 |

| Revenue | 3,338 | 3,551 | 8,969 | 10,649 | 14,977 |

| Other operating income | 29 | -235 | 117 | 242 | 254 |

| Material and services | -1,105 | -1,281 | -2,941 | -3,691 | -5,287 |

| Gross profit | 2,262 | 2,035 | 6,146 | 7,199 | 9,944 |

| Operating profit/loss (EBIT) | -278 | -1,109 | -2,312 | -2,563 | -2,596 |

| Items affecting comparability | |||||

| IPO related expenses | 0 | 386 | 0 | 904 | 139 |

| Adjusted EBIT | -278 | -723 | -2,312 | -1,659 | -2,457 |

| Depreciation, amortization and impairment losses | 507 | 563 | 1,640 | 1,678 | 2,261 |

| Adjusted EBITDA | 229 | -160 | -671 | 19 | -196 |

Consolidated income statement

| In thousands of euro | Q3/2020 | Q3/2019 | Q1-Q3/ 2020 |

Q1-Q3/ 2019 |

2019 |

| Revenue | 3,338 | 3,551 | 8,969 | 10,649 | 14,977 |

| Other operating income | 29 | -235 | 117 | 242 | 254 |

| Materials and services | -1,105 | -1,281 | -2,941 | -3,691 | -5,287 |

| Employee benefit expenses | -1,484 | -1,591 | -5,158 | -5,156 | -7,299 |

| Depreciation, amortisation and Impairment losses | -507 | -563 | -1,640 | -1,678 | -2,261 |

| Other operating expenses | -549 | -990 | -1,659 | -2,928 | -2,980 |

| Operating result | -278 | -1,109 | -2,312 | -2,563 | -2,596 |

| Finance income | 102 | -13 | 256 | 4 | 8 |

| Finance expenses | -143 | -129 | -528 | -293 | -365 |

| Net finance expenses | -41 | -142 | -272 | -289 | -356 |

| Profit (loss) before income taxes | -432 | -1,251 | -2,584 | -2,852 | -2,952 |

| Income tax expense | 20 | -4 | 59 | 34 | 77 |

| Loss for the period | -412 | -1,256 | -2,525 | -2,817 | -2,875 |

| Loss for the period attributable to | |||||

| Owners of the parent company | -412 | -1,256 | -2,525 | -2,817 | -2,875 |

| Loss per share attributable to owners of the parent company | |||||

| Weighted average number of shares | 13,080,477 | 8,935,654 | 13,080,477 | 8,935,654 | 8,935,654 |

| Basic loss per share (euro) | -0.02 | -0.14 | -0.19 | -0.32 | -0.32 |

Consolidated condensed comprehensive income statement

| In thousands of euro | Q3/2020 | Q3/2019 | Q1-Q3/2020 | Q1-Q3/2019 | 2019 |

| Loss for the period | -412 | -1,256 | -2,525 | -2,817 | -2,875 |

| Other comprehensive income | |||||

| Items that may be subsequently reclassified to profit or loss | |||||

| Foreign currency translation difference | 59 | 14 | 68 | 18 | 14 |

| Other comprehensive income, net of tax | 59 | 14 | 68 | 18 | 14 |

| Total comprehensive income for the period | -353 | -1,242 | -2,570 | -2,799 | -2,862 |

| Total comprehensive loss attributable to Owners of the parent company | -353 | -1,242 | -2,570 | -2,799 | -2,862 |

Consolidated balance sheet

| In thousands of euro | Sept 30, 2020 | Dec 31, 2019 |

| ASSETS | ||

| Non-current assets | ||

| Goodwill | 4,256 | 4,256 |

| Development costs | 5,386 | 5,218 |

| Customer relationships | 1,663 | 1,829 |

| Technology | 763 | 840 |

| Other intangible assets | 484 | 519 |

| Total intangible assets | 12,552 | 12,662 |

| Tangible assets | 347 | 406 |

| Right-of-use assets | 772 | 1,075 |

| Deferred tax assets | 10 | 8 |

| Total non-current assets | 13,681 | 14,151 |

| Current assets | ||

| Inventories | 2,721 | 2,468 |

| Trade and other receivables | 3,590 | 4,125 |

| Cash and cash equivalents | 10,899 | 18,866 |

| Total current assets | 17,209 | 25,459 |

| Total assets | 30,890 | 39,611 |

| In thousands of euro | Sept 30, 2020 | Dec 31, 2019 |

| EQUITY | ||

| Share capital | 80 | 80 |

| Share premium | 504 | 504 |

| Reserve for invested non-restricted equity | 37,413 | 37,341 |

| Translation differences | 157 | 89 |

| Retained earnings | -15,082 | -12,500 |

| Profit (loss) for the financial year | -2,525 | -2,875 |

| Total equity | 20,547 | 22,637 |

| LIABILITIES | ||

| Non-current liabilities | ||

| Borrowings from financial institutions | 3,257 | 5,104 |

| Government loans | 2,998 | 2,998 |

| Lease liabilities | 471 | 699 |

| Deferred tax liabilities | 559 | 616 |

| Total Non-current liabilities | 7,284 | 9,416 |

| Current liabilities | ||

| Borrowings from financial institutions | 0 | 1,766 |

| Government loans | 263 | 60 |

| Lease liabilities | 347 | 414 |

| Trade and other payables | 2,448 | 5,318 |

| Total current liabilities | 3,058 | 7,557 |

| Total liabilities | 10,342 | 16,973 |

| Total equity and liabilities | 30,890 | 39,611 |

Consolidated statement of changes in shareholders’ equity

| Equity attributable to owners of the parent company |

||||||

| In thousands of euro | Share capital | Share premium | Reserve for invested non-restricted equity | Translation differences | Retained earnings | Total |

| Balance at January 1, 2020 | 80 | 504 | 37,341 | 89 | -15,376 | 22,637 |

| Comprehensive income | ||||||

| Loss for the period | -2,525 | -2,525 | ||||

| Other comprehensive income | ||||||

| Translation differences | 68 | 68 | ||||

| Total comprehensive income for the period | 68 | -2,525 | -2,456 | |||

| Share issue | ||||||

| Share options | 72 | 294 | 366 | |||

| Total transactions with owners of the company | 72 | 294 | 366 | |||

| Balance at September 30, 2020 | 80 | 504 | 37,413 | 157 | -17,607 | 20,547 |

| Equity attributable to owners of the parent company |

||||||

| In thousands of euro | Share capital |

Share premium | Reserve for invested non-restricted equity | Translation differences | Retained earnings | Total |

| Balance at January 1, 2019 | 18,5 | 565 | 18,549 | 75 | -13,656 | 5,552 |

| Comprehensive income | ||||||

| Loss for the financial year | -2,817 | -2,817 | ||||

| Other comprehensive income | ||||||

| Translation differences | 18 | 18 | ||||

| Total comprehensive income for the financial year |

18 | -2,817 | -2,799 | |||

| Share issue | 3,000 | 3000 | ||||

| Share options | 349 | 349 | ||||

| Total transactions with owners of the company |

3,000 | 349 | 3,349 | |||

| Balance at September 30, 2019 | 19 | 565 | 21549 | 93 | -16,123 | 6,102 |

| Equity attributable to owners of the parent company |

||||||

| In thousands of euro | Share capital |

Share premium | Reserve for invested non-restricted equity | Translation differences | Retained earnings | Total |

| Balance at January 1, 2019 | 19 | 565 | 18,549 | 75 | -13,656 | 5,552 |

| Comprehensive income | ||||||

| Loss for the financial year | -2,875 | -2,875 | ||||

| Other comprehensive income | ||||||

| Translation differences | 14 | 14 | ||||

| Total comprehensive income for the financial year |

14 | -2,875 | -2,862 | |||

| Share issue | 61 | -61 | 18,792 | 694 | 19,486 | |

| Share options | – | 461 | 461 | |||

| Total transactions with owners of the company |

61 | -61 | 18,792 | 1,155 | 19,947 | |

| Balance at December 31, 2019 | 80 | 504 | 37,341 | 89 | -15,376 | 22,637 |

Consolidated cash flow statement

| In thousands of euro | Q3/2020 | Q3/2019 | Q1-Q3/2020 | Q1-Q3/2019 | 2019 |

| Cash flows from operating activities | |||||

| Loss for the financial year | -299 | -1,256 | -2,525 | -2,817 | -2,875 |

| Adjustments: | |||||

| Depreciation, amortisation and impairment losses |

507 | 563 | 1,640 | 1,678 | 2,261 |

| Finance income and finance expenses | 42 | 135 | 270 | 269 | 356 |

| Other adjustments | 56 | 70 | 154 | 326 | 466 |

| Cash flows before change in net working capital | 306 | -488 | -457 | -545 | 207 |

| Change in net working capital: | |||||

| Change in trade and other receivables (increase (-) / decrease (+)) |

-657 | 638 | 578 | -312 | -783 |

| Change in inventories (increase (-) / decrease (+)) |

128 | -347 | -262 | -1,212 | -1,346 |

| Change in trade and other payables (increase (+) / decrease (-)) |

-164 | -215 | -2,828 | 489 | 2,396 |

| Cash flows before finance items | -386 | -412 | -2,969 | -1,580 | 475 |

| Interest paid | -19 | -64 | -58 | -147 | -202 |

| Other finance expenses paid | -129 | -55 | -476 | -119 | -136 |

| Interest received | 134 | 0 | 288 | 7 | 24 |

| Net cash from operating activities (A) | -400 | -530 | -3,215 | -1,839 | 161 |

| Cash flows from investing activities | |||||

| Acquisition of intangible assets | -349 | -250 | -1,007 | -836 | -1,175 |

| Acquisition of tangible assets | -49 | -65 | -162 | -192 | -261 |

| Acquisition of subsidiary, net of cash acquired | 0 | 0 | 0 | 2 | 1 |

| Net cash used in investing activities (B) | -398 | -314 | -1,169 | -1,026 | -1,434 |

| Cash flows from financing activities | |||||

| Proceeds from share subscriptions | 72 | 0 | 72 | 3,000 | 23,000 |

| Share issue transaction costs | 0 | 0 | 0 | 0 | -4,208 |

| Proceeds from loans and borrowings | 4 | 138 | -170 | 136 | 176 |

| Repayment of loans and borrowings | -60 | -84 | -3,233 | -274 | -460 |

| Repayment of lease liabilities | -98 | -97 | -295 | -287 | -385 |

| Net cash from financing activities (C) | -82 | -43 | -3,626 | 2,575 | 18,123 |

| Net cash from (used in) operating, investing and financing activities (A+B+C) | -880 | -887 | -8,010 | -290 | 16,849 |

| Net increase (decrease) in cash and cash equivalents | -880 | -887 | -8,010 | -290 | 16,849 |

| Cash and cash equivalents at beginning of period | 11,742 | 2,607 | 18,866 | 2,000 | 2,000 |

| Effect of movements in exchange rate on cash held | 39 | 1 | 42 | 11 | 17 |

| Cash and cash equivalents at end of period | 10,899 | 1,721 | 10,899 | 1,721 | 18,866 |

Selected notes

Corporate information and basis of accounting

Corporate information

Optomed is a Finnish medical technology group (hereafter ‘Optomed’ or ‘Group’) that specialises in handheld fundus cameras and solutions for screening of blinding eye diseases, established in 2004.

The Group’s parent company, Optomed Plc. (hereafter the ‘company’) is a Finnish public limited liability company established under the laws of Finland, and its business ID is 1936446-1. It is domiciled in Oulu, Finland and the Company’s registered address is Yrttipellontie 1, 90230 Oulu, Finland.

This report has not been prepared in accordance with IAS 34 Interim Financial Reporting. This Interim financial statements do not include all of the information required for a complete set of IAS 34 financial statements: selected explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in the Group`s financial position and performance since the last annual financial statements.

Reportable segments

Q3/2020

| In thousands of euro | Devices | Software | Group admin | Total |

| External revenue | 1,537 | 1,802 | 3,338 | |

| Net operating expenses | -604 | -472 | 0 | -1,076 |

| Margin | 933 | 1,330 | – | 2,262 |

| Depreciation and amortisation | -352 | -155 | 0 | -507 |

| Other expenses | -642 | -886 | -505 | -2,033 |

| Operating result | -62 | 289 | -505 | -278 |

| Finance items | 0 | 0 | -41 | -41 |

| Loss before tax expense | -62 | 289 | -546 | -319 |

Q3/2019

| In thousands of euro | Devices | Software | Group admin | Total |

| External revenue | 1,863 | 1,688 | 3,551 | |

| Net operating expenses | -1,095 | -421 | 0 | -1,517 |

| Margin | 768 | 1,267 | – | 2,035 |

| Depreciation and amortisation | -408 | -156 | 0 | -563 |

| Other expenses | -923 | -840 | -817 | -2,580 |

| Operating result | -562 | 271 | -817 | -1,109 |

| Finance items | 0 | 0 | -142 | -142 |

| Loss before tax expense | -562 | 271 | -959 | -1,251 |

Q1-Q3/2020

| In thousands of euro | Devices | Software | Group Admin | Total |

| External revenue | 3,359 | 5,610 | 8,969 | |

| Net operating expenses | -1,487 | -1,336 | -2,823 | |

| Margin | 1,872 | 4,274 | – | 6,146 |

| Depreciation and amortisation | -1,185 | -455 | -1,640 | |

| Other expenses | -2,123 | -2,983 | -1,711 | -6,817 |

| Operating result | -1,437 | 836 | -1,711 | -2,312 |

| Finance items | 0 | 0 | -272 | -272 |

| Loss before tax expense | -1,437 | 836 | -1,983 | -2,584 |

Q1-Q3/2019

| In thousands of euro | Devices | Software | Group Admin | Total |

| External revenue | 5,152 | 5,497 | – | 10,649 |

| Net operating expenses | -2,064 | -1,385 | 0 | -3,449 |

| Margin | 3,087 | 4,112 | – | 7,199 |

| Depreciation and amortisation | -1,133 | -545 | 0 | -1,678 |

| Other expenses | -3,335 | -2,922 | -1,827 | -8,084 |

| Operating result | -1,381 | 646 | -1,827 | -2,563 |

| Finance items | 0 | 0 | -289 | -289 |

| Loss before tax expense | -1,381 | 646 | -2,116 | -2,852 |

| In thousands of euro | Devices | Software | Group Admin | Group |

| External revenue | 7,309 | 7,668 | 14,977 | |

| Net operating expenses | -3,109 | -1,924 | -5,033 | |

| Margin | 4,200 | 5,744 | – | 9,944 |

| Depreciation and amortisation | -1,504 | -757 | -2,261 | |

| Other expenses | -4,609 | -4,077 | -1,593 | -10,279 |

| Operating result | -1,913 | 909 | -1,593 | -2,596 |

| Finance items | 0 | 0 | -356 | -356 |

| Loss before tax expense | -1,913 | 909 | -1,949 | -2,952 |

2019

Financial liabilities

| In thousands of euro | 30.9.2020 | 31.12.2019 |

| Non-current financial liabilities | ||

| Borrowings from financial institutions | 3,257 | 5,104 |

| Government loans | 2,998 | 2,998 |

| Lease liabilities | 471 | 699 |

| Total | 6,726 | 8,800 |

| Current financial liabilities | ||

| Borrowings from financial institutions | 0 | 1,766 |

| Government loans | 263 | 60 |

| Lease liabilities | 347 | 414 |

| Trade payables | 579 | 1,667 |

| Total | 1,189 | 3,907 |

| Total financial liabilities | 7,652 | 12,707 |

The financial loans have been restructured during the 2020. Financial loans were paid prematurely 3,173 thousand euros. Within next 12 months there will be no amortization for borrowings from financial institutions.

| Fair values – financial liabilities measured at amortised cost | |||

| Optomed considers that the carrying amounts of the financial liabilities measured at amortised cost substantially equal to their fair values. | |||