The Initial Public Offering of Optomed Plc.

Optomed Plc's IPO was oversubscribed and the listing was completed as planned. Trading of the company’s shares commenced on the official list of Nasdaq Helsinki on 9 December 2019.

The Initial Public Offering of Optomed Plc.

Optomed Plc is a Finnish medical technology company and one of the leading providers of handheld fundus cameras.1 By combining the devices with software and artificial intelligence, the company aims to provide complete solutions that can make the screening process more efficient and reduce the societal costs of blinding diseases.

Optomed as an investment

- Optomed is one of the leading players in the growing and transforming handheld fundus camera market1

- Future growth potential from expansion into new markets and end-customer segments

- Provider of proprietary technology with targeted value propositions for different markets and healthcare systems

- Asset-light organisation through outsourced production and distribution, with a well-defined sales strategy and extensive distribution network

- Experienced management to promote the transformation of the fundus screening market

Seppo Kopsala, CEO and the founder of Optomed:

“We are extremely happy and proud of the wide interest expressed in our initial public offering. Optomed is a Finnish medical technology company in expansion phase and one of the leading providers of handheld fundus cameras. The purpose of our offering was to raise funds to implement our growth strategy, to strengthen the company’s recognition and to increase the liquidity of our shares. With the offering, Optomed received over 2,300 new owners, and our shares were subscribed by Finnish and international institutional investors and private investors in Finland and Sweden. The successful offering serves as a solid base to continue our work on the global challenge of diabetic retinopathy. We are passionate about developing unique technological innovations, which enable eye screenings for anyone in need globally. We want to warmly thank everyone involved in our offering for their trust and willingness to take part in our growth story.”

Reasons for the offering

- to improve the company’s ability to successfully pursue its growth strategy and invest in its business in order to remain at the forefront of developing complete screening solutions against blinding eye diseases and expand into new markets

- allow Optomed to obtain access to capital markets and broaden its ownership base with both domestic and foreign investors, which would increase the liquidity of the shares.

- strengthen Optomed’s recognition and brand awareness among customers, business partners and investors, thus enhancing Optomed’s competitiveness and the market’s awareness of handheld fundus cameras.

- The increased liquidity would also enable Optomed to use the shares more effectively as a means of consideration in potential acquisitions and remuneration of personnel.

Initial public offering

Optomed Plc issued a total of 4,444,444 new shares in the company. In addition, Aura Capital Oy, Halma Ventures Limited and certain other existing shareholders in the company decided, in accordance with the terms and conditions of the offering, to increase the offering and to sell 1,702,575 shares in the company.

In the public offering, 624,871 offer shares were allocated to private individuals and entities in Finland and Sweden and 6,444,200 offer shares were allocated in private placements to institutional investors in Finland and internationally.

Optomed Plc received gross proceeds of EUR 20 million from the offering before deduction of the costs relating to the listing, and the selling shareholders received gross proceeds of approximately EUR 15,9 million. The total number of Optomed Plc’s outstanding shares amounts to 13,192,144 shares and the total number of the company’s registered shares amounts to 14,003,144.

Subscription price

The subscription price for the offered shares was EUR 4.50 per share.

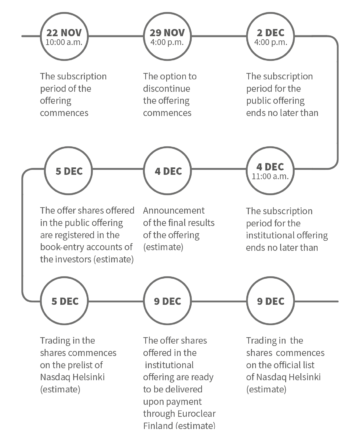

Important dates

Investor event

- Hotelli Kämp, Symposion (Kluuvikatu 4 B, 00100 Helsinki) 28 November at 4:30 pm – 7:30 pm

Watch the video from the investor event here.

Materials

- Prospectus

- Marketing brochure (only in Finnish)

- Terms and conditions of the IPO

- Articles of Association*

- Swedish summary – Sammanfattning

*The Articles of Association are in effect as of the Listing.

Releases

Optomed Plc applies for its shares to be listed on the official list of Nasdaq Helsinki Ltd

The IPO of Optomed Plc has been oversubscribed and the listing will be completed as planned

1 Zion Market Research (2018). In the management’s view, the company’s leading position is based on the share of revenue in the handheld fundus camera market that is generated from sales of cameras manufactured by the company and sold to end-users by the company’s OEM customers, distributors and directly by the company.