Optomed’s Financial Statements Bulletin January–December 2019

Optomed Plc, stock exchange release, 28 February 2020 at 9.00 EET

October–December 2019 highlights

- Revenue decreased, as expected by 7.7 percent to EUR 4,329 (4,688) thousand

- Strong sales within the Devices segment’s OEM channel and Software segment were offset by a large Chinese customer postponing orders to 2020, affecting both the fourth quarter and full year revenue

- Adjusted EBITDA amounted to EUR -211 (1,102) thousand corresponding to -4.9 (23.5) percent of revenue

- Successful initial public offering (IPO) concluded in December 2019, which strengthened the company’s cash position, balance sheet and equity ratio with gross proceeds of 20 MEUR, before the payment of IPO related expenses

January–December 2019 highlights

- Revenue increased by 3.6 percent to EUR 14,977 (14,463) thousand on a proforma basis, a low single digit growth as expected

- Adjusted EBITDA amounted to EUR -196 (1,661) thousand and -1.3 (11.5) percent of revenue

Key figures

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations |

CEO comments

The year 2019 was an important year for Optomed with several highlights, including a very successful market expansion of our handheld fundus camera, Aurora, opening of several complimentary sales channels for our products and over-subscribed initial public offering (IPO) on Nasdaq Helsinki’s main list. We now have the right products as well as the funds needed to grow and expand our business to new markets and customer segments globally. Based on the Aurora market expansion, our Distributor channel sales grew by 21.2 percent and our private label distribution (OEM) by 13.8 percent and we started several direct sales projects with our cameras and artificial intelligence (AI) based eye screening solutions. Our software segment performed well, and revenue grew by 9.5 percent. This growth was mainly driven by success in the healthcare sector, especially in the last quarter. Optomed group total revenue growth for 2019 was 3.6 percent.

During the year we expanded our distribution network to reach over 60 countries in the EMEA and APAC regions. Our new Aurora camera was registered in several new key markets, including Japan and Russia. In the second quarter we also signed a new strategic OEM partnership with one of the leading global brands in the ophthalmology equipment business. This new OEM camera called the “Signal”, was launched to the market in September 2019, adding again one new important sales channel for Optomed globally. Our direct sales team won new diabetic retinopathy (DR) screening projects in Asia, Middle East and Africa, and part of these projects already started to materialize as revenue during the year. The eye screening projects, various pilots, clinical validation studies and other commercialization activities led to strategically important early customers for our Artificial Intelligence (AI) based solutions. AI is still in the very early stages of commercialization in ophthalmology, but it is gaining momentum and being incorporated into different healthcare systems in all main markets.

China is an important market for Optomed. We have our own subsidiary there with 15 employees in sales and marketing. In 2019, our business to the public healthcare sector remained stable and predictable, but we faced some challenges in our private healthcare business with one large private screening operator postponing their camera orders from 2019 to the second half of 2020. We expect the coronavirus outbreak to have a negative effect on our revenue, especially in the first half of the year. Despite these challenges, we believe that the fundaments for demand of our screening solutions in China are strong, and also the private healthcare sector will recover in the near future. Our expected highlights in China for 2020 are our Aurora camera CFDA-registration (China Food and Drug Administration) and launch, as well as our large screening operator’s recovery back to their normal order cycles.

We expect handheld cameras to continue gaining market share as one of the fastest growing product categories within the global fundus camera market, and large new screening programs for diabetic retinopathy continue to emerge especially in Asia, Middle East, Africa and Latin America. Private screening operators often choose to purchase handheld cameras instead of traditional desktop machines because of mobility, ease of use and lower investment cost. Also because of the limited amount of ophthalmologist resources available, AI continues to gain clinical and commercial acceptance around the world. We believe that we have the right products and a strong position to capitalize on this opportunity in the coming years. In the first half of 2020 we will focus on our growth strategy and take actions to expand our activities into new markets, such as the United States. We are also investing heavily on the development of our first, fully integrated AI camera, that can screen various eye diseases easier, faster and more accurately than ever before. We expect to launch this product in 2020.

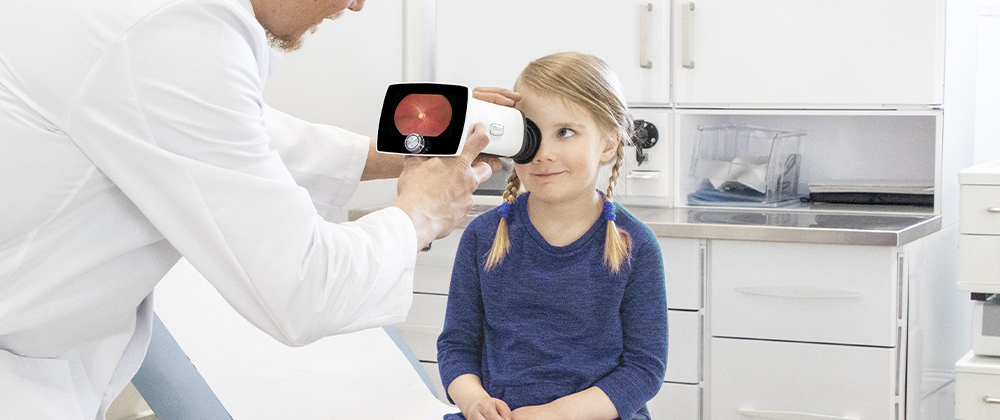

Today, Optomed is a well-recognized medical technology company listed on Nasdaq Helsinki and a world-leading manufacturer of handheld fundus cameras. In combination with software and artificial intelligence, our cameras can make eye screening more efficient and improve the availability and access to screening. Our mission together with our partners and customers is to stop the growth of avoidable blindness globally by bringing high quality and cost-effective eye examinations to primary care.

I want to sincerely thank all our investors, both institutional and private, as well as our employees, partners and customers for the trust and support of our mission and growth strategy.

Seppo Kopsala, CEO

Outlook 2020

We continue to progress our expansion towards the US and grow our international distributor network. Additionally, we are currently investing in the development of our first fully integrated AI camera with expected commercial launch during 2020.

Optomed expects its revenue to grow during 2020 and that the growth will focus on the second half of the year.

The COVID-19 Coronavirus outbreak may have a negative impact on the company’s growth affecting both the business in China and the overall business due to the company’s Chinese component suppliers. Further, in case the virus becomes pandemic the company’s global sales could be negatively affected.

Group performance

October–December 2019

Group revenue decreased by 7.7 percent to EUR 4,329 (4,688) thousand in the fourth quarter. Software segment performed well, and the revenue increased by 18.6 percent driven by a strong performance of services sales to healthcare organizations. On the other hand, Devices segment’s revenue decreased by 24.4 percent. The decrease was mainly caused by a Chinese private screening operator customer postponing orders from 2019 to 2020. The gross margin decreased from 75.3 percent to 63.4 percent. In 2018, the company received a governmental grant of EUR 420 thousand, which increased the gross margin of the comparison period. The fourth quarter 2018 gross margin adjusted for the total amount of the grants would have been 66.3 percent. The remaining decrease of 2.9 percent was due to segment and product mix.

EBITDA amounted to EUR 550 (968) thousand and adjusted EBITDA totaled EUR -211 (1,102) thousand. Adjusted EBITDA was positively affected by the reclassifications of the IPO related expenses of EUR 760 (135) thousand from operating expenses to equity in the fourth quarter 2019. The IPO related expenses are classified as items affecting comparability. The EBITDA was also negatively affected by the strengthening of the management, sales and marketing functions as key investments in future growth. EBIT was EUR -33 (453) thousand and adjusted EBIT was EUR -794 (588) thousand.

Net financial items amounted to EUR -67 (-102) thousand and consisted mainly of interest payments to financial institutions and the translation effect of Chinese RMB to EUR.

January–December 2019

Revenue increased by 3.6 percent to EUR 14,977 (14,463, pro forma) thousand for the full year 2019. The revenue of the Devices segment decreased 2.0 percent driven by the postponed Chinese orders. Software segment performed well and grew 9.5 percent, mainly due to the good performance of the healthcare sector.

EBITDA amounted to EUR -335 (1,188) thousand and adjusted EBITDA totaled EUR -196 (1,661) thousand. Adjusted EBITDA was positively affected by the IPO related expenses of EUR 139 (135). In 2018, the adjusted EBITDA was also affected by Commit; Oy acquisition related expenses of EUR 191 thousand.

EBIT was EUR -2,596 (-664) and adjusted EBIT was EUR -2,457 (-338) thousand. The IPO and acquisition related expenses are classified as items affecting comparability.

Net profit was -2,875 (-1,327).

Net financial items amounted to EUR -356 (-555) thousand. Net loss per share was EUR 0.32 (0.17).

Cash flow and financial position

Optomed’s cash position, balance sheet and equity ratio were significantly strengthened by the IPO gross proceeds of EUR 20 million in December 2019. Total IPO related fees and expenses amounted to EUR 4,208 in total, of which EUR 139 thousand was affecting the profitability and remaining EUR 4,069 thousand was booked to equity.

In the fourth quarter, cash flow from operating activities amounted to EUR 2,000 (1,375) thousand, of which increase in trade and other payables explains the positive variance versus 2018. In January–December 2019 cash flow from operating activities amounted to EUR 161 (-76) thousand. Net cash used in investing activities was EUR -1,434 (-8,765) for the full year 2019 and EUR -408 (-178) for the fourth quarter. The full year increase was related to the acquisition of Commit; Oy, and the main variance for the fourth quarter was sale of financial asset in 2018.

Consolidated cash and cash equivalents at the end of the period amounted to EUR 18,866 (2,000) thousand. Interest-bearing net debt totalled EUR -8,938 (8,207) thousand at the end of the period.

Net working capital was EUR 1,276 (1,640) thousand at the end of the year 2019. Compared to the end of September 2019, the net working capital decreased by EUR 1,379 thousand, mainly due to increased trade and other payables.

Devices segment

Optomed has two synergistic business segments: Devices and Software.

The Devices segment develops, commercializes and manufactures easy-to-use, and affordable handheld fundus cameras, that are suitable for any clinic for screening of various eye diseases, such as diabetic retinopathy, glaucoma and AMD (Age Related Macular degeneration).

| EUR, thousand | 10-12/2019 | 10-12/2018 | Change, % | 1-12/2019 | 1-12/2018 | Change, % |

| Revenue | 2,158 | 2,857 | -24.4% | 7,309 | 7,460 | -2.0% |

| Gross profit * | 1,114 | 2,087 | -46.6% | 4,200 | 5,053 | -16.9% |

| Gross margin % * | 51.6% | 73.0% | 57.5% | 67.7% | ||

| EBITDA | -168 | 648 | -126.9% | -408 | 221 | -284.6% |

| EBITDA margin *, % | -7.8% | 22.7% | -5.6% | 3.0% | ||

| Operating result (EBIT) | -539 | 221 | -343.9% | -1,913 | -1,323 | -44.5% |

| Operating margin (EBIT) *, % | -25.0% | 7.7% | -26.2% | -17.7% |

*) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations

| EUR, thousand | 10-12/2019 | 10-12/2018 | Change, % | 1-12/2019 | 1-12/2018 | Change, % |

| Revenue by channel | 2,158 | 2,856 | -24.4% | 7,309 | 7,460 | -2.0 % |

| – Distributors | 560 | 561 | -0.2% | 1,662 | 1,370 | 21.3 % |

| – OEM | 1,189 | 1,042 | 14.1% | 3,373 | 2,964 | 13.8 % |

| – China | 296 | 1,136 | -73.9% | 1,795 | 2,686 | -33.2 % |

| – Other | 113 | 117 | -3.4% | 479 | 440 | 8.9 % |

October–December 2019

The Devices segment revenue decreased 24.4 percent in the fourth quarter. Distributor sales were down 0.2 percent, OEM sales up 14.1 percent and China sales down 73.9 percent. The key driver for the decrease was a Chinese key customer postponing large orders to 2020. However, at the same time the OEM business of the Devices segment performed well and executed initial shipments to a new OEM customer, Topcon.

The gross margin decreased to 51.6 percent from 73.0 percent in the previous year. In the fourth quarter 2018, the company received governmental grants of EUR 420 thousand, which increased the gross margin of the comparison period. In 2018, the fourth quarter gross margin adjusted for the total amount of the grants would have been 58.3 percent. The remaining decrease is related to product and customer mix.

EBITDA was EUR -168 (648) thousand or -7.8 (22.7) percent of revenue. The key driver for the decrease in EBITDA was the decreased revenue and higher operating expenses related to new recruitments in sales and marketing functions.

January–December 2019

In January–December 2019, the Devices segment revenue decreased 2.0 percent and was EUR 7,309 (7,460) thousand. The gross margin decreased from 67.7% to 57.5% percent and EBITDA was EUR -408 (221) thousand or –5.6 (3.0) percent of revenue. In 2018 the company received government grants of EUR 881 thousand, which increased the gross margin of the comparison period.

The weakened financial performance was mainly due to a postponed order in China.

Software segment

Optomed has two synergistic business segments: Devices and Software.

The Software segment develops and commercializes screening software for diabetic retinopathy and cancer screening for healthcare organizations. The segment also distributes off-the-shelf products from selected partners to supplement its own solutions and expertise and provides software consultation to support the Devices segment screening solution projects.

| Pro forma | |||||||||

| EUR, thousand | 10-12/2019 | 10-12/2018 | Change,% | 1-12/2019 | 1-12/2018 | Change, % | |||

| Revenue | 2,171 | 1,831 | 18.6% | 7,668 | 7,001 | 9.5% | |||

| Gross profit * | 1,632 | 1,442 | 13.2% | 5,744 | 5,344 | 7.5% | |||

| Gross margin % * | 75.2% | 78.8% | 74.9% | 76.3% | |||||

| EBITDA | 477 | 320 | 49.1% | 1,667 | 1,112 | 49.9% | |||

| EBITDA margin *, % | 22.0 % | 17.5% | 21.7% | 15.9% | |||||

| Operating result (EBIT) | 264 | 233 | 13.3% | 909 | 660 | 13.3% | |||

| Operating margin (EBIT) *, % | 12.2% | 12.7% | 11.9% | 9.4% | |||||

*) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations.

October–December 2019

Software segment had a strong fourth quarter and the revenue increased 18.6 percent and was EUR 2,171 (1,831) thousand. The increase was driven by a successful delivery of new software solution projects and maintenance and support services as well as growth in recurring license sales to various healthcare organizations. EBITDA was EUR 477 (320) thousand or 22.0 (17.5) percent of revenue, an increase of 49.1 percent.

January–December 2019

The Software segment’s revenue increased 9.5 percent and was EUR 7,668 (7,001) thousand. The gross margin decreased from 76.3 percent to 74.9 percent. EBITDA was EUR 1,667 (1,112) thousand or 21.7 (15.9) percent of revenue.

Software segment performance was driven by successful delivery of new software solution projects and maintenance and support services as well as growth in recurring license sales to various healthcare organizations.

Organic growth

The following table shows the organic growth of the group and the segments. The adjusted elements are related to the acquisition of Commit; Oy executed in the first quarter of 2018 and exchange rate variances between EUR and Chinese RMB. Commit; Oy forms today the foundation of the Software segment.

| Organic growth, percentage | 10-12/2019 | 1-12/2019 | ||

| Devices segment* | -24.6% | -2.4% | ||

| Software segment* | 18.6% | 6.9% | ||

| Group* | -7.8% | 1.5% |

*) Alternative performance measures, see section Alternative Performance Measures for definitions and calculations.

Group-wide expenses

Group-wide expenses relate to functions supporting the entire group such as treasury, group accounting, legal, HR, IT and public listing expenses.

October–December 2019

Group-wide operating expenses amounted to EUR 617 thousand. Group-wide operating expenses includes a reclassification of IPO expenses from operating expenses to equity of EUR 760 (135) thousand. Group-wide expenses amounted to EUR 143 thousand excluding the IPO expenses. The IPO expenses are classified as items affecting comparability.

January–December 2019

Group-wide operating expenses amounted to EUR 488 thousand. Group-wide expenses include EUR 139 (135) thousand of IPO related expenses for the full year 2019. For the financial year 2018, Group-wide expenses included Commit; Oy acquisition related expenses of EUR 191 thousand. The acquisition and IPO related expenses are classified as items affecting comparability.

IPO expenses

Total IPO related fees and expenses amounted to EUR 4,208 in total, of which EUR 139 thousand was affecting the profitability and the remaining EUR 4,069 thousand was booked to equity.

Personnel

Number of personnel at the end of the reporting period.

| 12/2019 | 12/2018 | |||

| Devices | 59 | 61 | ||

| Software | 36 | 36 | ||

| Group common | 13 | 8 | ||

| Total | 108 | 105 |

Corporate Governance

Optomed complies with Finnish laws and regulations, Optomed’s Articles of Association, the rules of Nasdaq Helsinki and the Finnish Corporate Governance Code 2020 issued by the Securities Market Association of Finland. The code is publicly available at http://cgfinland.fi/en/. Optomed publishes its corporate governance statement on the company website www.optomed.com

Annual General Meeting

The Annual General Meeting (“AGM”) of Optomed Plc was held on 10 May 2019. The AGM adopted the financial statements and discharged the members of the Board of Directors and the CEO from liability for the financial year 2018. The meeting approved the Board of Directors’ proposal not to pay dividend for the year.

Petri Salonen, Matthew Hallam, Ingo Ramesohl, Anders Torstensson and Jun Wu were re-elected and Seppo Mäkinen, Reijo Tauriainen and Jens Umehag were elected as members of the Board. The Board of Directors elected Petri Salonen as the Chairperson and the members of the Committees as follows:

Audit Committee: Reijo Tauriainen (chairperson) Petri Salonen, Matthew Hallam and Jens Umehag.

Remuneration Committee: Petri Salonen (chairperson), Ingo Ramensohl and Anders Torstensson.

Shares and shareholders

The company has one share series with all shares having the same rights. At the end of the review period Optomed Plc’s share capital consisted of 14,003,144 shares and the company held 811,000 shares in the treasury which corresponds approximately 5.8 percent of the total amount of the shares and votes. Additional information with respect to the shares, shareholding and trading can be found on the company’s website www.optomed.com.

Risks and uncertainties

COVID-19 coronavirus

China has faced an outbreak of COVID-19 coronavirus in early 2020.

China is a major market for Optomed and the company also utilizes Chinese suppliers in its supply chain.

The company may be adversely affected if the Chinese medical devices market faces a prolonged downturn due to the outbreak. Further, the company may be adversely affected in case Chinese component suppliers are not able to produce and deliver components in sufficient quantities for the company to continue to manufacture and deliver its devices. The company also recognizes the risk that the virus may become pandemic which would have an adverse effect on the company’s global sales.

High quality products

The quality and safety of the Company’s products are extremely important for competitiveness.

The company may be adversely affected if it fails to continuously develop and update its fundus cameras and software solutions or to identify or integrate new products and product platforms into its offering.

Strategy and M&A

The company may be unsuccessful in fulfilling its strategy or the strategy itself may be unsuccessful.

The successful implementation of the company’s strategy depends upon several factors, some of which are completely or partially outside the company’s control. The company has an appropriate risk management function in the context of the size of the company’s operations, however, it may not be able to identify or monitor all relevant risks and determine efficient risk management procedures and responsible persons that may again affect the strategy. The company is also dependent on its ability to develop and manage varying routes-to-market for its products, the efficiency of its sales channels and its customer and distributor relationships. Further, the company has an opportunistic view on M&A which by nature include inherent risks. Failure of strategy may force the company to record write-downs on its goodwill.

Market and competition

The company operates in a market that is highly competitive.

Optomed operates in the fundus camera market that is developing fast and the competition is sometimes fierce. The market acceptance of the company’s products and solutions is important for its future growth. Optomed recognizes a possibility of new market changing products entering the market. Further, in certain key geographies Optomed’s client base is limited and, therefore, a loss of a key customer in a key market may adversely affect the Company’s revenue streams.

External economic and political risks and natural disasters

Optomed operates globally and is thus exposed to various external risks.

The company is exposed to natural disasters taking place in countries where it operates. In addition to these, the company is also exposed to general and country specific, economic, political and regulatory risks, which could entail volatile sales in key markets.

Supply chain

Optomed’s business is dependent on the effectiveness of purchasing materials, manufacturing and timely distribution.

The company is dependent on contract manufacturers for functioning, efficient and effective production and product assembly. Further, the company is dependent on suppliers which may affect the company’s ability to supply its customers in a timely manner.

Systems and information

Optomed’s operations are increasingly dependent on IT systems.

Disruption of the company’s IT systems could inhibit the business operations in a number of ways, including disruption to financial reporting, sales, production and cash flows.

Litigation

Optomed operates globally and pursues double digit annual organic growth in medium term.

Optomed may not always be able to reach the best contractual terms with stakeholders. The company may be negatively affected by legal or administrative proceedings directed at the company or third parties due to back-to-back liability, or other disputes and claims including product liability, especially in terms of medical devices, and intellectual property rights related items.

Trade secrets and patents

The technological capabilities are a competitive advantage that the company must be able to protect.

The company may not be able to protect its trade secrets and know-how which could lead to losing the competitive advantage the company has. At the same time, the company may be forced to take actions against parties that violate Optomed’s IPRs.

Talent & organisation

A skilled workforce and agile organisation are essential for the continued success of the business.

The company may be adversely affected if it would lose its key personnel or fails to attract the right talent.

Finance

The company needs external financing to operate and is not currently profitable.

The company is dependent on external financing and the company may have difficulties accessing additional financing on competitive terms or at all which may again contribute the company’s liquidity risks. The company is also subject to credit and counterparty risks through its trade receivables.

Forex

Optomed operates globally and is thus exposed to currency exchange risks.

The company is exposed to foreign exchange rate risks arising from fluctuations in currency exchange rates, especially with regards to USD, EUR and RMB. Currency rates, along with demand cycles, can result in significant swings in the prices of the raw materials needed to produce the Company’s goods, sales prices and OPEX.

Legal and regulatory

Compliance with laws and regulations is an essential part of Optomed’s business operations.

Optomed and its’ suppliers and distributors operate globally and are subject to various national and regional regulations in the areas of medical devices, product safety, product claims, data protection, intellectual property rights, health and safety, competition, employment, taxes and anti-money laundering and anti-bribery & corruption (AML & ABC). Furthermore, many of the company’s devices are subject to various medical related assessment (including clinical trials), clearance and approval processes that are required to introduce the Company’s products on the markets.

Failure to comply with the regulations might lead to loss of sales permits in different markets, product recalls, reputational issues, civil and criminal actions leading to various direct and indirect damages to Optomed and its employees that are not completely covered by Optomed’s insurance coverage. Especially, failures with respect to compliance with certain medical devices related regulations and processes may hinder the company’s devices market access.

Other events

On 5 December 2019, trading of the company’s shares commenced on the prelist of Nasdaq Helsinki Ltd and on the official list of Nasdaq Helsinki on 9 December 2019.

On 12 December 2019, the company announced that it has received a notification from Universal-Investment-Gesellschaft mit beschränkter Haftung (“Universal Investments”) according to which the total holdings in Optomed shares and votes held by Universal Investments has increased to 7.49 per cent of all of the registered shares in Optomed on 5 December 2019.

On 20 December 2019, the company announced the exercise of over-allotment option in relation to the IPO of Optomed Plc and termination of the stabilisation period.

The Board’s proposal for the distribution of profit

The parent company’s non-restricted equity on December 31, 2019 was EUR 21 736 790,31 and the net loss for the financial year was EUR 5,490,536.34. The Board of Directors proposes to the Annual General Meeting that no dividend will be paid and the non-restricted equity on the outstanding 14,003,144 shares shall be retained and carried forward.

Events after the review period

On 28 January 2020, the company refinanced its bank loans and repaid an amount of EUR 3,173 thousand.

On 3 February 2020, the company announced the proposal of the Nomination board. The Nomination Board proposes to the Annual General Meeting 2020 that Seppo Mäkinen, Petri Salonen, Reijo Tauriainen and Jun Wu are re-elected as Board members and Anna Tenstam is elected as a new Board member.

Audit review

This Financial Statements Bulletin report has been audited by the company’s auditors.

Financial reporting in 2020

Week 12 at the latest Annual Report 2019

29 May 2020 Interim Report for 1 January – 31 March 2020

27 August 2020 Half-Year Financial Report for 1 January – 30 June 2020

25 November 2020 Interim Report for 1 January – 30 September 2020

For more information, contact

Lars Lindqvist, CFO

Tel.: +46 702 59 57 89

E-mail: lars.lindqvist@optomed.com

Seppo Kopsala, CEO

Tel.: +358 40 555 1050

E-mail: seppo.kopsala@optomed.com

About Optomed

Optomed is a Finnish medical technology company and one of the leading providers of handheld fundus cameras. Optomed combines handheld screening devices with software and artificial intelligence with the aim to transform the diagnostic process of blinding eye-diseases such as rapidly increasing diabetic retinopathy. In its business Optomed focuses on eye-screening devices and software solutions related R&D in Finland and sales through different channels in over 60 countries. The company has an extensive portfolio of 55 international patents protecting the technology. In 2019, Optomed’s revenue reached EUR 15 million and pro forma revenue amounted to EUR 14.5 million. At the end of 2019, Optomed employed 108 professionals.

Alternative Performance Measures

Optomed uses certain alternative performance measures (APMs) with the purpose to provide a better understanding of how the business develops. These APMs, as defined, cannot be fully compared with other companies’ APMs.

| Alternative Performance Measures | Definition |

| Gross profit | Revenue + Other operating income – Materials and services expenses |

| Gross margin, % | Gross profit / Revenue |

| EBITDA | Operating result before depreciation, amortisation and impairment losses |

| EBITDA margin, % | EBITDA / Revenue |

| Operating result | Profit/loss after depreciation, amortisation and impairment losses |

| Operating margin, % | Operating result / Revenue |

| Adjusted operating result | Operating result excluding items affecting comparability |

| Adjusted operating margin, % | Adjusted operating result / Revenue |

| Adjusted EBITDA | EBITDA excluding items affecting comparability |

| Adjusted EBITDA margin % | Adjusted EBITDA / Revenue |

| Items affecting comparability | Material items outside ordinary course of business including restructuring costs, net gains or losses from sale of business operations or other non-current assets, strategic development projects, external advisory costs related to capital reorganisation, impairment charges on non-current assets incurred in connection with restructurings, compensation for damages and transaction costs related to business acquisitions. |

| Net Debt | Interest-bearing liabilities (borrowings from financial institutions, government loans and subordinated loans) – cash and cash equivalents (excl. lease liabilities according to IFRS 16) |

| Net Debt / Adjusted EBITDA (LTM), times | Net Debt / Adjusted EBITDA (for the last twelve months, LTM) |

| Earnings per share | Net result / Number of outstanding shares (reflecting changes in the number of shares following the resolution of the EGM to split the shares of the Company with a ratio of 1:20) |

| Equity ratio, % | Total equity / Total assets |

| R&D expenses | Employee benefit expenses for R&D personnel and other operational expenses related to R&D activities |

| Organic growth, % | Organic growth refers to revenue growth excluding (i) growth attributable to acquisitions and divestments; and (ii) growth attributable to fluctuations in exchange rates. The various components in organic growth is calculated as follows: Acquisitions and divestments: Shows how acquisitions and divestments completed during the relevant period have affected the reported revenues. To estimate the impact of acquisitions on reported revenue, the revenue from the contributions of the acquired units for the current period is subtracted from the total revenue for the same period. To estimate the impact of divestments on reported revenue, the revenue from the contributions from the divested units for the current period is subtracted from the total revenue from the previous respective comparison period. Currency Fluctuations: Shows how the reported revenue has been affected by the translation of revenue generated in other currencies than the euro (which is the Group’s accounting currency) when there are exchange rate differences between the current period and the corresponding comparative period. Income in currencies other than euro for the comparative period is recalculated using the applicable exchange rate for the current period to eliminate the effects of exchange rate fluctuations for the relevant period. |

Reconciliation of Alternative Performance Measures

| In thousands of euro | 10-12/2019 | 10-12/2018 | 2019 | Pro forma 2018 |

| Revenue | 4,329 | 4,688 | 14,977 | 14,463 |

| Other operating income | 11 | 420 | 254 | 889 |

| Material and services | -1,595 | -1,579 | -5,287 | -4,954 |

| Gross profit | 2,745 | 3,530 | 9,944 | 10,398 |

| Operating profit/loss (EBIT) | -33 | 453 | -2,596 | -664 |

| Items affecting comparability | ||||

| IPO related expenses | -760 | 135 | 139 | 135 |

| Acquisition related expenses | 0 | 0 | 0 | 191 |

| Adjusted EBIT | -794 | 588 | -2,457 | -338 |

| Depreciation, amortization and impairment losses | 583 | 515 | 2,261 | 1,997 |

| Adjusted EBITDA | -211 | 1,102 | -196 | 1,661 |

Reconciliation of organic growth

| Organic growth for the Group | 10-12/2019 | 10-12/2018 | 2019 | 2018 |

| Revenue | 4,329 | 4,688 | 14,977 | 12,733 |

| Acquisitions (elimination of revenues for comparability | 0 | 0 | -2,029 | 0 |

| Revenue excluding acquisitions | 4,329 | 4,688 | 12,948 | 12,733 |

| Currency effects | 0 | 6 | 0 | 26 |

| Revenue excluding acquisitions and currency effects | 4,329 | 4,694 | 12,948 | 12,759 |

| Organic growth, percent | -7.8% | 1.5% | ||

| Organic growth for the Devices segment | 10-12/2019 | 10-12/2018 | 2019 | 2018 |

| Revenue | 2,158 | 2,856 | 7,309 | 7,460 |

| Acquisitions (elimination of revenues for comparability) | 0 | 0 | 0 | 0 |

| Revenue excluding acquisitions | 2,158 | 2,856 | 7,309 | 7,460 |

| Currency effects | 0 | 6 | 0 | 26 |

| Revenue excluding acquisitions and currency effects | 2,158 | 2,862 | 7,309 | 7,486 |

| Organic growth, percent | -24.6% | -2.4% | ||

| Organic growth for the Software segment | 10-12/2019 | 10-12/2018 | 2019 | 2018 |

| Revenue | 2,171 | 1,831 | 7,668 | 5,273 |

| Acquisitions (elimination of revenues for comparability) | 0 | 0 | -2,029 | 0 |

| Revenue excluding acquisitions | 2,171 | 1,831 | 5,639 | 5,273 |

| Currency effects | 0 | 6 | 0 | 0 |

| Revenue excluding acquisitions and currency effects | 2,171 | 1,837 | 5,639 | 5,273 |

| Organic growth, percent | 18.2% | 6.9% |

Consolidated income statement

The principles for describing events after the interim period are the same as for events after the balance sheet date (IAS 10).

| In thousands of euro | Oct 1 – Dec 31, 2019 |

Jan 1 – Dec 31 2019 |

Oct 1 – Dec 31, 2018 |

Jan 1 – Dec 31, 2018 |

| Revenue | 4,329 | 14,977 | 4,688 | 12,733 |

| Other operating income | 11 | 254 | 420 | 889 |

| Materials and services | -1,595 | -5,287 | -1,579 | -4,568 |

| Employee benefit expenses | -2,143 | -7,299 | -1,825 | -5,137 |

| Depreciation, amortisation and impaiment losses | -583 | -2,261 | -515 | -1,810 |

| Other operating expenses | -52 | -2,980 | -738 | -2,855 |

| Operating result | -33 | -2,596 | 453 | -748 |

| Finance income | -40 | 8 | 16 | 22 |

| Finance expenses | -107 | -365 | -118 | -578 |

| Net finance expenses | -67 | -356 | -102 | -555 |

| Profit (loss) before income taxes | -101 | -2,952 | 351 | -1,303 |

| Income tax expense | 42 | 76 | 98 | -24 |

| Loss for the period | -58 | -2,875 | 449 | -1,327 |

| Loss for the period attributable to | ||||

| Owners of the parent company | -58 | -2,875 | 449 | -1,327 |

| Loss per share attributable to owners of the parent company | ||||

| Weighted average number of shares | 8,935,654 | 8,935,654 | 7,775,473 | 7,775,473 |

| Basic loss per share (euro) | -0,01 | -0,32 | 0,06 | -0,17 |

Consolidated condensed comprehensive income statement

| Loss for the period | -58 | -2,875 | -476 | -1,327 | |

| Other comprehensive income | |||||

| Items that may be subsequently reclassified to profit or loss | |||||

| Foreign currency translation difference | 10 | 14 | 5 | 13 | |

| Other comprehensive income, net of tax | 10 | 14 | 5 | 13 | |

| Total comprehensive income for the period |

-48 | -2,861 | -470 | -1,314 | |

| Total comprehensive loss attributable to | |||||

| Owners of the parent company | -48 | -2,861 | -470 | -1,314 | |

Consolidated balance sheet

| In thousands of euro | Dec 31, 2019 | Dec 31, 2018 | |||||||||

| ASSETS | |||||||||||

| Non-current assets | |||||||||||

| Goodwill | 4,256 | 4,256 | |||||||||

| Development costs | 5,218 | 5,172 | |||||||||

| Customer relationships | 1,829 | 2,051 | |||||||||

| Technology | 840 | 942 | |||||||||

| Other intangible assets | 540 | 376 | |||||||||

| Total intangible assets | 12,662 | 12,796 | |||||||||

| Tangible assets | 406 | 739 | |||||||||

| Right-of-use assets | 1,075 | 1,084 | |||||||||

| Financial instruments at fair value | 0 | 0 | |||||||||

| Deferred tax assets | 8 | 8 | |||||||||

| Total non-current assets | 14,151 | 14,627 | |||||||||

| Current assets | |||||||||||

| Inventories | 2,468 | 1,121 | |||||||||

| Trade and other receivables | 4,125 | 3,399 | |||||||||

| Cash and cash equivalents | 18,866 | 2,000 | |||||||||

| Total current assets | 24,459 | 6,519 | |||||||||

| Total assets | 39,611 | 21,146 | |||||||||

| Share capital | 80 | 19 | |||||||||

| Share premium | 504 | 565 | |||||||||

| Reserve for invested non-restricted equity | 37,341 | 18,549 | |||||||||

| Translation differences | 89 | 75 | |||||||||

| Retained earnings | -12,500 | -13,656 | |||||||||

| Profit (loss) for the financial year | -2,875 | ||||||||||

| Total equity | 22,637 | 5,552 | |||||||||

| LIABILITIES | |||||||||||

| Non-current liabilities | |||||||||||

| Borrowings from financial institutions | 5,104 | – | |||||||||

| Government loans | 2,998 | 2,993 | |||||||||

| Lease liabilities | 699 | 727 | |||||||||

| Preference share liability | 0 | 694 | |||||||||

| Deferred tax liabilities | 616 | 693 | |||||||||

| Total non-current liabilities | 9,416 | 5,107 | |||||||||

| Current liabilities | |||||||||||

| Borrowings from financial institutions | 1,766 | 7,010 | |||||||||

| Government loans | 60 | 204 | |||||||||

| Lease liabilities | 414 | 393 | |||||||||

| Trade and other payables | 5,317 | 2,880 | |||||||||

| Total current liabilities | 7,557 | 10,487 | |||||||||

| Total liabilities | 16,973 | 15,594 | |||||||||

| Total equity and liabilities | 39,611 | 21,146 | |||||||||

Consolidated statement of changes in shareholders equity

| Equity attributable to owners of the parent company | ||||||||||

| In thousands of euro | Note | Share capital |

Share premium | Reserve for invested non-restricted equity | Translation differences | Retained earnings | Total | |||

| Balance at January 1, 2019 | 19 | 565 | 18,549 | 75 | -13,656 | 5,552 | ||||

| Comprehensive income | ||||||||||

| Profit (loss) for the period | – | – | – | – | -2,875 | -2,875 | ||||

| Translation differences | – | – | – | 14 | 14 | |||||

| Total comprehensive income for the period | – | – | – | 14 | -2,875 | -2,861 | ||||

| Transactions with owners of the company |

||||||||||

| Share issue | 19 | 61 | -61 | 18,792 | – | 694 | 19,486 | |||

| Share options | 7 | – | – | – | – | 461 | 461 | |||

| Total transactions with owners of the company | 61 | -61 | 18,792 | – | 1,155 | 19,947 | ||||

| Balance at December 31, 2019 | 80 | 504 | 37,341 | 89 | -15,376 | 22,637 | ||||

| Equity attributable to owners of the parent company | |||||||||

| In thousands of euro | Note | Share capital |

Share premium | Reserve for invested non-restricted equity | Translation differences | Retained earnings | Total | ||

| Balance at January 1, 2018 | 19 | 565 | 13,049 | 62 | -12,532 | 1,162 | |||

| Comprehensive income | |||||||||

| Profit (loss) for the period | – | – | – | -1,327 | -1,327 | ||||

| Translation differences | – | – | – | 13 | 13 | ||||

| Total comprehensive income for the period | – | – | – | 13 | -1,327 | -1,314 | |||

| Transactions with owners of the company |

|||||||||

| Share issue | 19 | – | – | 5,500 | – | – | 5,500 | ||

| Share options | 7 | – | – | – | – | 203 | 203 | ||

| Total transactions with owners of the company | – | – | 5,500 | – | 203 | 5,703 | |||

| Balance at Dec 31, 2018 | 19 | 565 | 18,549 | 75 | -13,656 | 5,552 | |||

Consolidated cash flow statement

| In thousands of euro | Oct 1 – Dec 31, 2019 |

Jan 1 – Dec 31, 2019 |

Oct 1 – Dec 31, 2018 |

Jan 1 – Dec 31, 2018 | ||||||||||

| Cash flows from operating activities | ||||||||||||||

| Loss for the financial year | -58 | -2,875 | 449 | -1,327 | ||||||||||

| Adjustments: | ||||||||||||||

| Depreciation, amortisation and impairment losses | 583 | 2,261 | 515 | 1,810 | ||||||||||

| Finance income and finance expenses | 61 | 356 | 102 | 555 | ||||||||||

| Other adjustments | 166 | 466 | -32 | 228 | ||||||||||

| Cash flows before change in net working capital | 752 | 207 | 1,033 | 1,267 | ||||||||||

| Change in net working capital: | ||||||||||||||

| Change in trade and other receivables (increase (-) / decrease (+)) | -468 | -783 | -217 | -958 | ||||||||||

| Change in inventories (increase (-) / decrease (+)) | -135 | -1,346 | 132 | -50 | ||||||||||

| Change in trade and other payables (increase (+) / decrease (-)) | 1,905 | 2,396 | 428 | -126 | ||||||||||

| Cash flows before finance items | 2,054 | 475 | 1,377 | 133 | ||||||||||

| Interest paid | -55 | -202 | -66 | -218 | ||||||||||

| Other finance expenses paid | -17 | -136 | -5 | -86 | ||||||||||

| Interest received | 17 | 24 | 2 | 2 | ||||||||||

| Income taxes paid | 0 | 0 | 67 | 93 | ||||||||||

| Net cash from operating activities (A) | 2,000 | 161 | 1,375 | -76 | ||||||||||

| Cash flows from investing activities | ||||||||||||||

| Acquisition of intangible assets | -338 | -1,175 | -410 | -1,295 | ||||||||||

| Acquisition of tangible assets | -70 | -260 | -148 | -404 | ||||||||||

| Proceeds from sale of intangible assets | 0 | 0 | 0 | 8 | ||||||||||

| Proceeds from sale of tangible assets | 0 | 0 | 0 | 133 | ||||||||||

| Acquisition of subsidiary, net of cash acquired | 0 | 0 | 0 | -7,604 | ||||||||||

| Dividends received | 0 | 0 | 0 | 16 | ||||||||||

| Proceeds from sale of financial assets | 0 | 0 | 380 | 380 | ||||||||||

| Net cash used in investing activities (B) | -408 | -1,434 | -178 | -8,765 | ||||||||||

| Cash flows from financing activities | ||||||||||||||

| Proceeds from share subscriptions | 20,000 | 23,000 | 0 | 5,500 | ||||||||||

| Share issue transaction costs | -4,208 | -4,208 | 0 | 0 | ||||||||||

| Proceeds from loans and borrowings | 41 | 176 | 14 | -5,192 | ||||||||||

| Repayment of loans and borrowings | -186 | -460 | -175 | -537 | ||||||||||

| Repayment of lease liabilities | -98 | -385 | -98 | -342 | ||||||||||

| Net cash from financing activities (C) | 15,547 | 18,123 | -259 | 9,814 | |||||||

| Net cash from (used in) operating, investing and financing activities (A+B+C) | 17,139 | 16,858 | 938 | 972 | |||||||

| Net increase (decrease) in cash and cash equivalents | 17,139 | 16,858 | 938 | 972 | |||||||

| Cash and cash equivalents at beginning of period | 1,721 | 2,000 | 1,055 | 1,032 | |||||||

| Effect of movements in exchange rate on cash held | 6 | 17 | 6 | -5 | |||||||

| Cash and cash equivalents at end of period | 18,866 | 18,866 | 2,000 | 2,000 | |||||||

Selected notes

- Corporate information and basis of accounting

1.1 Corporate information

Optomed is a Finnish medical technology group (hereafter ‘Optomed’ or ‘Group’) that specialises in hand-held fundus cameras and solutions for screening of blinding eye diseases, established in 2004.

The Group’s parent company, Optomed Plc. (hereafter the ‘Company’) is a Finnish public limited liability company established under the laws of Finland, and its business ID is 1936446-1. It is domiciled in Oulu, Finland and the Company’s registered address is Yrttipellontie 1, 90230 Oulu, Finland.

1.2 Basis of accounting

Optomed’s consolidated financial statements has been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union. The preparation of this interim report also takes into account the amendments to IFRS standards that have become effective by September 30, 2019. In the EU IFRS are standards and their interpretations adopted in accordance with the procedure laid down in regulation (EC) No 1606/2002 of the European Parliament and of the Council. Optomed has consistently applied these policies, unless otherwise stated. The Group has not applied any standard, interpretation or amendment thereto before its effective date.

This report have been prepared in accordance with IAS 34 Interim Financial Reporting, and should be read in conjunction with Group`s last annual consolidated financial statements as at and for the year ended 31 December 2019. This Interim financial statements do not include all of the information required for a complete set of IFRS financial statements: selected explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in the Group`s financial position and performance since the last annual financial statements.

This report has been were authorised for issue by the Company`s board of directors.

Optomed’s financial statements are assuming that the Company will continue as a going concern. The going concern basis presumes that the Group has adequate resources to remain in operation, and that management intends to do so, for at least one year from the date the financial statements are signed.

Reportable segments

Q4/2019

| In thousands of euro | Devices | Software | Group Admin | Group, IFRS | |

| External revenue | 2,158 | 2,171 | 4,329 | ||

| Net operating expenses | -1,044 | -539 | -1,584 | ||

| Margin | 1,114 | 1,632 | 2,744 | ||

| Depreciation and amortisation | -371 | -213 | -583 | ||

| Other expenses | -1,282 | -1,155 | 242 | -52 | |

| Operating result | -539 | 264 | 242 | -33 | |

| Finance items | – | – | -67 | -67 | |

| Loss before tax expense | -539 | 264 | 175 | -101 | |

Q4/2018 |

|||||

| In thousands of euro | Devices | Software | Group Admin | Group, IFRS | |

| External revenue | 2,857 | 1,831 | 4,688 | ||

| Net operating expenses | -770 | -389 | -1,159 | ||

| Margin | 2,087 | 1,442 | 3,530 | ||

| Depreciation and amortisation | -428 | -86 | -515 | ||

| Other expenses | -1,439 | -1,122 | -1,251 | ||

| Operating result | 221 | 233 | 454 | ||

| Finance items | 0 | 0 | -102 | -102 | |

| Loss before tax expense | 221 | 233 | -102 | 352 | |

2019 |

|||||

| In thousands of euro | Devices | Software | Group Admin | Group, IFRS | |

| External revenue | 7,309 | 7,668 | 14,977 | ||

| Net operating expenses | -3,109 | -1,924 | -5,033 | ||

| Margin | 4,200 | 5,744 | – | 9,944 | |

| Depreciation and amortisation | -1,504 | -757 | -2,261 | ||

| Other expenses | -4,609 | -4,077 | -1,593 | -10,279 | |

| Operating result | -1,913 | 909 | -1,593 | -2,596 | |

| Finance items | 0 | 0 | -356 | -356 | |

| Loss before tax expense | -1,913 | 909 | -1,949 | -2,952 | |

2018 |

|||||||

| In thousands of euro | Devices | Software | Group Admin | Group, IFRS | |||

| External revenue | 7,460 | 5,273 | 12,733 | ||||

| Net operating expenses | -2,132 | -1,269 | -3,401 | ||||

| Margin | 5,328 | 4,004 | 9,332 | ||||

| Depreciation and amortisation | -1,130 | -166 | -1,296 | ||||

| Other expenses | -3,394 | -2,036 | -5,430 | ||||

| Operating result | -1,559 | 358 | -1,201 | ||||

| Finance items | 0 | 0 | -453 | -453 | |||

| Loss before tax expense | -1,559 | 358 | -453 | -1,654 | |||

Revenue

| In thousands of euro | Q4/2019 | Q4/2018 | 2019 | 2018 | ||||

| Finland | 1,945 | 1,793 | 7,308 | 48,8 % | 5,021 | 39,4 % | ||

| China | 295 | 1,185 | 1,795 | 12,0 % | 2,753 | 21,6 % | ||

| Other | 2,087 | 1,712 | 5,874 | 39,2 % | 4,960 | 39,0 % | ||

| Total | 4,327 | 4,690 | 14,977 | 100,0 % | 12,733 | 100,0 % | ||

Tangible assets

| In thousands of euro | Machinery and equipment |

Machinery and equipment |

||

| 2019 | 2018 | |||

| Cost | ||||

| Balance at January 1 | 1,729 | 1,185 | ||

| Business combinations | 274 | |||

| Additions | 262 | 270 | ||

| Disposals | – | – | ||

| Effect of movements in exchange rates |

– | – | ||

| Balance at December 31 | 1,992 | 1,729 | ||

| Accumulated depreciation | ||||

| and impairment losses | ||||

| Balance at January 1 | -990 | -555 | ||

| Depreciation | -595 | -435 | ||

| Impairment losses | – | |||

| Effect of movements in exchange rates |

– | |||

| Balance at December 31 | -1,585 | -990 | ||

| Carrying amount at January 1 | 739 | 631 | ||

| Carrying amount at December 31 | 406 | 739 | ||

Leases

| Leased tangible assets | ||||||

| In thousands of euro | 31.12.2019 | 31.12.2018 | ||||

| Additions to right-of-use assets | 378 | 840 | ||||

| Carrying amount at the end of the reporting period | 1,075 | 1,084 | ||||

| Leased tangible assets comprise business premises and are presented as a separate line item Right-of-use assets in the consolidated balance sheet. | ||||||

| Lease liabilities | ||||||

| In thousands of euro | 31.12.2019 | 31.12.2018 | ||||

| Current | 414 | 393 | ||||

| Non-current | 699 | 727 | ||||

| Total | 1,113 | 1,120 | ||||

| The weighted average Optomed’s incremental borrowing rate applied for discounting purposes was 3.2 %. | ||||||

| The above liabilities are presented on the line item Lease liabilities (non-current / current) in the consolidated balance sheet, based on their maturity. | ||||||

Intangible assets and goodwill

| At December 31 2019 | Goodwill | Develop- ment costs | Customer relationships | Technology | Other intangible assets | Total | ||

| In thousands of euro | ||||||||

| Cost | ||||||||

| Balance at January 1 | 4,256 | 7,353 | 2,222 | 1,023 | 543 | 15,397 | ||

| Business combinations | – | |||||||

| Additions | 894 | – | – | 316 | 1,210 | |||

| Balance at December 31 | 4,256 | 8,246 | 2,222 | 1,023 | 859 | 16,606 | ||

| – | ||||||||

| Accumulated amortisation | – | |||||||

| and impairment losses | – | |||||||

| Balance at January 1 | – | -2,181 | -170 | -82 | -168 | -2,601 | ||

| Amortisation | -848 | -222 | -102 | -172 | -1,344 | |||

| Balance at December 31 | -3,029 | -392 | -184 | -340 | -3,945 | |||

| – | ||||||||

| Carrying amount at January 1 | 4,256 | 5,172 | 2,051 | 942 | 376 | 12,796 | ||

| Carrying amount at December 31 | 4,256 | 5,218 | 1,829 | 840 | 519 | 12,662 | ||

During twelve months ended 31 December 2019, no impairment losses were detected.

| At December 31, 2018 | Goodwill | Develop-ment costs | Customer relationships | Technology | Other intangible assets | Total | ||

| In thousands of euro | ||||||||

| Cost | ||||||||

| Balance at January 1 | – | 6,295 | – | – | 261 | 6,557 | ||

| Business combinations | 4,256 | – | 2,222 | 1,023 | 44 | 7,545 | ||

| Additions | – | 1,058 | – | – | 238 | 1,296 | ||

| Balance at December 31 | 4,256 | 7,353 | 2,222 | 1,023 | 543 | 15,397 | ||

| Accumulated amortisation | ||||||||

| and impairment losses | ||||||||

| Balance at January 1 | – | -1,480 | – | – | -95 | -1,575 | ||

| Amortisation | – | -701 | -170 | -82 | -73 | -1,026 | ||

| Balance at December 31 | – | -2,181 | -170 | -82 | -168 | -2,601 | ||

| Carrying amount at January 1 | – | 4,816 | – | – | 166 | 4,982 | ||

| Carrying amount at December 31 | 4,256 | 5,172 | 2,051 | 942 | 376 | 12,796 | ||

Capital and reserves

See financial covenants and covenant breach.

Financial liabilities

| In thousands of euro | 31.12.2019 | 31.12.2018 | |||

| Non-current financial liabilities | |||||

| Borrowings from financial institutions | 5,104 | – | |||

| Government loans | 2,998 | 2,993 | |||

| Subordinate loan | – | – | |||

| Lease liabilities | 699 | 727 | |||

| Preference share liability | – | 694 | |||

| Total | 8,800 | 4,414 | |||

| Current financial liabilities | |||||

| Borrowings from financial institutions | 1,766 | 7,010 | |||

| Government loans | 60 | 204 | |||

| Subordinate loan | – | – | |||

| Lease liabilities | 414 | 393 | |||

| Trade payables | 1,667 | 732 | |||

| Total | 3,907 | 8,339 | |||

| Total financial liabilities | 12,707 | 12,753 | |||

Financial covenant and covenant breach

Optomed’s borrowings from financial institutions contain a financial covenant (equity ratio) and Optomed also has to meet certain key operative targets. The related liabilities amounted to EUR 6,696 thousand (7,006 thousand at December 31, 2018). The borrowings will be repaid in accordance with the repayment schedule.

Optomed has to comply with the financial covenant terms specified in the loan agreement terms at the financial year-end. Equity ratio is calculated in FAS figures using the agreed formula. The table below summarises the Group’s financial covenant term and compliance during 2018 and the reporting period.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The covenant was breached at December 31, 2018, and consequently the related borrowings from financial institutions were classified as current as at December 31, 2018. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related party transactions

| In thousands of euro | Revenues | Trade receivables | Other expenses |

| Jan 1 – Dec 31 2019 | 2,200 | 1,172 | -143 |

| Jan 1 – Dec 31 2018 | 3,233 | 1,594 | -74 |

Revenue and trade receivables and some of the other expenses relate to the major shareholders of Optomed Ltd considered to be related parties to the parent company.

| Other expenses consist of consulting fees and travel expenses paid to the Chairman of the Board of Directors. |